The CA Quarterly Review (Fall 2025)

NEWS & INFORMATION QUARTERLY FOR OWNERS & AGENTS OF THE PERFORMANCE BASED CONTRACT ADMINistrator FOR NORTHERN CALIFORNIA

- Orange you happy it's finally fall?

-

- Best Practices to Foster Good Rapport with Tenants

-

Fostering a good rapport with your tenants is a vital part of property ownership and management. Building these relationships takes time, effort, and commitment. Here are a few strategies to help you build strong owner/management-tenant relationships:

Be Fair and Consistent

- Set aside preconceived notions and show the highest consideration and understanding.

- Make it a constant goal to comprehend the viewpoints and problems of your tenants.

- Treat Tenants with respect.

Maintain Quality Communication

- Good communication is essential for building trust, resolving conflicts, and promoting collaboration.

- Effective communication can foster understanding, minimize misunderstandings, and enhance relationships.

- Encourage Tenants to share their feedback.

- Always communicate with professionalism and promptness.

Be Receptive and Available

- Be prompt and proactive in addressing your tenant’s concerns.

- Communicate availability clearly.

- Be consistent with follow-up.

- Practice good communication skills.

Be Responsive and Proactive with Maintenance Issues

- Ensure the property is safe, clean, and well-maintained to create a more pleasant living environment that will foster good tenant satisfaction.

- Prioritize Tenant’s safety and security.

- Be diligent with unit inspections

Building strong relationships with your tenants is essential to the success of your property management strategy. By maintaining clear communication, addressing maintenance issues promptly, showing appreciation, ensuring a safe and clean environment, and fostering mutual respect, you create a positive relationship for both sides.

- How Project-Based Gross Rent Changes Impact Tenants

-

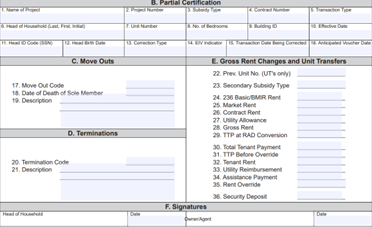

A gross rent change is a change in rent, utility allowance (UA), or both that is processed by HUD or the Contract Administrator. These changes typically occur annually, but for some properties may occur more or less frequently. Gross rent changes can change the Contract Rents at the property and the UA amounts which can affect Tenant Rent and utility reimbursement, if applicable.

For actions requiring preparation of a HUD-50059-A, the owner must sign and date the completed HUD-50059-A. The head of household must sign and date the completed HUD-50059-A when there is a change in the amount of rent the household must pay, a change in the utility reimbursement, when there is a unit transfer and when required by state or local law. In all instances where a HUD-50059-A is prepared, the owner must provide the head of household with a copy and a copy must be retained in the tenant file. If required, Tenant signatures must be obtained within 60 days from the date the gross rent change is implemented by the owner, as evidenced by the owner’s submission of the voucher whereby the owner begins vouchering for assistance based on the new rents. Signatures for a unit transfer or when required by state or local law must be obtained before submitting the data to the Contract Administrator or TRACS.

For example, let’s review one possible scenario* for a Gross Rent Change at a property with a 11/01/2025 HAP Anniversary date:

05/01/2025: Owner sends notification to tenants of intent to increase rents with a UA decrease at least 30 days before submitting a request to HUD for approval of an increase in maximum permissible rents. The Owner ensures materials are available in office for tenants to view and provide comments, if desired.

07/01/2025: Owner has submitted all the required documentation for their rent adjustment.

07/28/2025: Contract Administrator/HUD approves rent increase.

08/01/2025: Owner sends 30-day notice to tenants to notify of rent increase due to the UA decrease.

10/02/2025: Owner submits voucher with updated rent amounts.

10/05/2025: Owner provides HUD-50059-A to tenants and requests signatures, if applicable.

11/01/2025: Tenants first updated rent will be due (must not be implemented until after the 30-day notice expires).

12/01/2025: If signatures are required, Owner must have signed HUD-50059-A’s collect which will be maintain in tenant files.

*Keep in mind this example is based on a process that was completed without any delays or complications.

Possible Notices/Communications Connected with Gross Rent Changes

- HUD-50059-A: Provides tenant with changes in Gross Rent and/or UA (Tenant will only sign/date if change results in change in tenant rent or utility reimbursement)

- Notice of Intention to Submit a Request to HUD for Approval of an Increase in Maximum Permissible Rents (only applicable for certain types of Gross Rent Changes): Informing tenants that Owner is submitting paperwork for potential gross rent changes

- 30-Day Tenant Notification for UA Decrease: A decrease in UA will result in an increase in Tenant Rent

- HOTMA Forms Posted to MFH Drafting Table: Comment Period Has Begun!

-

The Office of Multifamily Housing Programs (MFH) published updated Housing Opportunity Through Modernization Act of 2016 (HOTMA) related forms to the Drafting Table to ensure stakeholders have adequate time to consider and offer comments on proposed changes to these forms.

The comment period runs from 9/17/2025 through 10/17/2025. HUD provides the following instructions to submit comments:

Send comments and recommendations via https://www.reginfo.gov/public/do/PRAMain. Find this particular information collection by selecting ‘‘Currently under Review—Open for Public Comments’’ and using the search function. HUD recommends using “Department of Housing and Urban Development” as your search term, then looking for OMB Control Number 2502-0204.

For questions regarding the HOTMA related forms, please contact MFH_HOTMA@hud.gov.

- How the PBCA Contact Center Can Be Utilized to Promote Relationships

-

Contact Center Purpose

The Contact Center has a team of Customer Relation Specialists (CRS) that are ready to receive all inquiries from tenants, applicants, owners, managing agents, and the general public. Inquiries can be submitted via phone, email, mail, or fax and will be promptly assigned to a CRS. The CRS will investigate and communicate with the inquirer until the inquiry is resolved. The Contact Center is dedicated to providing effective, timely help to all inquirers and to HUD’s mission to provide decent, safe, and sanitary housing. The Contact Center is a helpful resource for a variety of inquiries, including the following:

- Questions about rent

- Questions about notifications received

- Concerns about maintenance issues

- Questions about Annual Recertifications

- Questions about HUD Handbook 4350.3

What to Expect from Start to Finish When Working with The Contact Center

At initial inquiry, the CRS will request the following information:

- Property Name

- Caller’s Name (anonymous calls accepted)

- Caller’s Telephone Number including area code

- Caller’s Address including unit number

- A brief, detailed description of the caller’s concern(s)

After the initial inquiry is received, the following will be the processing procedure:

- If Owner involvement is required –

- CRS will notify the Owner of the incoming inquiry within one hour of the initial inquiry being received

- CRS will follow-up with Inquirer within one hour of the initial inquiry being received to confirm Owner has been notified

- All inquiries –

- CRS will follow-up every 3-5 business days, as needed, until inquiry is resolved

- CRS will not close inquiry until all parts of inquiry are solved and clear communication has been given to inquirer

- For any inquiry that deals with a safety concern, the inquiry is not resolved until the CRS confirms with the complainant that all issues were resolved and/or repairs were completed.

Specific Situations When the Contact Center Cannot Actively Be Involved

As governed by HUD Handbook 4381.5 Chapter 4, Section 4.8, there are certain circumstances under which CRS staff must refrain from becoming actively involved. HUD’s policy is designed to maintain impartiality and avoid conflicts of interest in legal matters. The Handbook specifies that CRS staff should avoid involvement in:

- Disputes involving third parties: These are issues where external parties are involved, and our intervention could be seen as taking sides or influencing the outcome.

- Suits brought by residents against owners/agents, or vice versa: Legal disputes between residents and property management are matters for the courts to resolve, and our role is to remain neutral.

- Eviction matters: Evictions are legal processes that must be handled according to local laws and regulations, and our involvement could disrupt the legal proceedings.

- Interpretations of local laws and ordinances: Local laws can vary significantly and interpreting them is beyond our scope. Legal professionals should handle these interpretations to ensure accuracy and compliance.

By adhering to these HUD guidelines, the Contact Center protects the integrity of its operations and ensures that they do not inadvertently influence legal outcomes or violate HUD policies.

How Documentation of Inquiry Can Be Released To Resident Representatives or Legal Aid

As Contract Administrators under federal agencies, the Contact Center is required to adhere to the requirements of the Freedom of Information Act (FOIA). Requests for PBCA documents must be submitted directly to HUD as a FOIA submission. To ensure all applicable documents are provided, FOIA requests should include adequate details such as: PBCA Name, Property Name, tenant name (if applicable), property/tenant address, PBCA Inquiry Number, and any other relevant details to fulfill your request.

How Owners and Tenants can Utilize the Contact Center to Help Promote Positive, Effective Relationships

Putting Tenant satisfaction as a top priority can ensure the success of a property. The Contact Center plays a crucial role in enhancing the relationship between tenants and owners by providing quick and efficient customer support. Here are some ways the Contact Center can help build trust and improve tenant satisfaction:

- Timely Resolutions: The Contact Center is dedicated to working efficiently and effectively to guarantee a resolution for every inquiry.

- Customer Support: The team of Customer Relation Specialists at the Contact Center are highly trained to handle inquiries with the utmost care to make certain that no misunderstandings occur and trust is built.

- Open Communication: The Contact Center CRS team work as neutral, third-parties to promote open communication between tenants and Owners/Managing Agents.

- HUD Publishes FY2026 Fair Market Rents (FMR) and Small Area Fair Market Rents (SAFMR)

-

Click here for FY26 FMR

Click here for FY26 SAFMR

The FY26 FMRs and SAFMRs are effective October 1, 2025.

- Partner Spotlight - LCS - Congratulations, Robert Caldwell !!

-

Explain your position with CGI-

I am a Local Contract Specialist with CGI.

My responsibilities include performing on-site file reviews of Section 8 subsidized multifamily properties in Northern California. My core task includes analysis, interpretation, and reporting on owner/agent compliance with regulations, policies, and procedures found in the U.S Department of Housing and Urban Development (HUD). I direct corrective actions to bring Section 8 properties into compliance with HUD regulations.

How long have you been with CGI?

I am just starting back with CGI after a 10-year break. I have been back in my current role at CGI for two months now. Prior to me leaving CGI I worked here for 11 years.

What was your background prior to joining CGI?

Before joining CGI, I built a strong foundation as a successful Sales Representative in corporate sales within the telecom industry, consistently ranking as a top performer.

What are your hobbies? Things you enjoy doing after you leave the office.

My hobbies outside of work- I enjoy playing golf, traveling, working out, watching my son play high school football and talking to my daughter while she is away in college. During football season, you can usually find me cheering for my Dallas Cowboys, and I also value spending time with family and friends.

What brings you the most satisfaction in your day-to-day tasks?

What I find most rewarding in my day-to-day role is helping owners and agents in the Section 8 industry stay compliant by keeping them informed about the latest rules and regulations. I also greatly appreciate the office staff I work alongside here at CGI. Many of them are still here after my 10-year absence and being part of such a dedicated and special group of people makes coming to work enjoyable.

What is the best piece of advice that you could provide to an owner/agent?

The best advice I can offer to any owner or agent is to continue asking questions, stay up to date with the HUD handbook, and always remember that I am here to help.

- Important Preventative Steps for a Pest-Free Property

-

As temperatures begin to cool, it’s that time of year when pests start to gravitate indoors to seek shelter and warmth. Although pests can be a problem year-round in most places, some particularly are more problematic in the fall and winter- the change in season alters pests' behavior and drives them indoors. So, consider these pest control tactics to prevent infestations:

Tenant Education and Communication—

Educating tenants and keeping lines of communication open can play crucial roles in maintaining a pest-free environment. Ensuring tenants understand basic pest-control preventive measures (such as decluttering, sealing food and trash, and animal care) and know how to contact the office if evidence of pests is observed can enhance overall pest management efficiency.

Indoor Cleanliness—

A great practice, if not already done on a regular basis, is to perform monthly or quarterly pest/housekeeping inspections of units as indoor cleanliness is paramount in pest prevention (especially has temperatures go down outside). Inspections can also facilitate prompt intervention to prevent any infestations from spreading if pests are already present in a unit.

Exterior of Property—

Most indoor pest problems originate from outdoors. So, maintaining the exterior of your property, and identifying vulnerabilities that allows pests to move in, is crucial in preventing pest entry. Seal up any cracks or crevices, clear any debris (such as leaves) away, and ensure doors and windows (including screens) are properly in place and sealed.

Yard Maintenance—

Regular yard and grounds maintenance can also play a role in pest control. Keeping grass cut, vegetation trimmed, and clearing debris directly disrupts pests’ ability to shelter and reproduce. Ensuring no standing water or falling produce exists on the property can also make a big difference.

By applying these preventative, cost-effective methods, property owners can significantly reduce the risk of future infestations. So be sure to be proactive!

- Reporting Changes Between Annual Recertifications

-

To ensure that assisted tenants pay rents appropriate with their ability to pay, tenants must report changes in family income and composition for use in interim recertifications of family income and composition in accordance with HUD requirements.

This article provides a brief summary of interim certifications. The HUD Handbook 4350.3, Rev-1, Chg-4, Chapter 7, Section 2, provides a full description of the program requirements and procedures for performing interim recertifications when a tenant experiences a change in income or family composition between annual recertifications.

- (NOTE: This article applies to the existing guidelines and does not integrate the new provisions of HOTMA)

Tenant Responsibilities

Tenants must notify the O/A when:

- A family member moves out of the unit;

- The family proposes to move a new member into the unit;

- An adult member of the family who was reported as unemployed on the most recent certification or recertification obtains employment; or

- The family’s income cumulatively increases by $200 or more per month.

Tenants may request an interim recertification due to any changes that may affect the TTP or tenant rent and assistance payment:

- Decreases in income (i.e. loss of employment, reduction in hours, loss /reduction of welfare income);

- Increases in allowances (i.e. medical expenses, childcare costs); and

- Other changes affecting the calculation of a family’s annual or adjusted income (i.e. family member turning 62 years old, becoming a full-time student or, becoming a person with a disability).

Tenants are not required to report when:

- A family member turns 18 years of age between annual recertifications.

- Tenants must follow the requirements in their lease for reporting changes in the household income.

- However, when a tenant turns 18 and has not signed the form HUD-9887, the O/A must not use the EIV income reports until the form is signed. Owners must address in their policies and procedures notification requirements and timeframes for tenants who turn 18 between annual recertifications to sign the consent forms HUD-9887 and HUD9887-A and/or lease. If the tenant fails to sign the consent form(s), the household is in non-compliance with their lease and their assistance and tenancy of the household may be terminated.

- Rent increases. O/A must implement the increase retroactive to the first of the month following the date that the action occurred.

- Rent decreases. Rent decreases must be implemented effective the first rent period following completion of the recertification.

NOTE: Section 236 and BMIR cooperatives must enforce the interim recertification procedures only for members who executed occupancy agreements after February 15, 1984. Cooperatives may impose interim recertification requirements on members who executed occupancy agreements prior to February 15, 1984, only if the cooperative amended its by-laws to make such requirements binding on all members or a member voluntarily agreed to include such clauses in his/her occupancy agreement.

Owner Responsibilities

When processing an interim recertification, the O/A must ask the tenant to identify all changes in income, expenses, or family composition since the last recertification. The O/A only needs to verify those items that have changed.Upon receiving a tenant request for an interim recertification, the O/A must process a recertification of family income and composition within a reasonable time, which is only the amount of time needed to verify the information provided by the tenant. Generally, this should not exceed 4 weeks.

The O/A must process an interim recertification if a tenant reports:

- A change in family composition;

- The O/A must screen the proposed additional person(s), including live-in aides, for drug abuse and other criminal activity, including a State lifetime sex offender registration check.

- The O/A must also obtain the new household member’s SSN, unless the household member does not contend eligible immigration status or is an individual age 62 or older as of January 31, 2010, and does not have a SSN but was receiving HUD rental assistance at another location on January 31, 2010. (See Chapter 3, Paragraph 3-9. D.7, Adding New Household Members.)

- The O/A must apply the additional owner established screening outlined in the property’s Tenant Selection Plan. In the case of live-in aides, the owner established screening criteria may also be applied, except for the criteria to pay rent on time.

- An increase in a family’s cumulative income of $200 or more a month;

- If a tenant reports any other change along with an increase in income that does not increase the household’s cumulative income by $200 or more a month, the owner should not include the increase in income in processing the interim recertification

- An increase in allowances;

- A change in citizenship or eligible immigration status of any family members, or

- Most decreases in income except in the circumstances described in the next paragraph.

The O/A may refuse to process an interim recertification when the tenant reports a decrease in income only if the following apply:

- The decrease was caused by a deliberate action of the tenant to avoid paying rent (e.g. O/A receives documented evidence that a tenant quits a job in order to qualify for a lower rent).

- The O/A has confirmation that the decrease will last less than one month (e.g. O/A receives confirmation from the tenant’s employer that the tenant will be laid off for only two weeks).

- If the O/A determines that the decrease in income will last less than one month, the O/A may choose, but is not obligated, to process an interim recertification.

- The O/A must, however, implement this policy consistently for all tenants in the property who experience a decrease in income that will last for less than one month.

- Owners do not have to perform interim recertifications for individual tenants who are paying market rent.

The O/A may delay, but not refuse, to process an interim recertification if they have confirmation that a tenant’s income will be partially or fully restored within two months. Processing may be delayed only until the new income is known.

- When owners decide to delay processing, the following apply:

- May require the tenant to pay the current amount of rent until the interim recertification is complete.

- Must not evict the tenant for nonpayment of rent.

- Must not charge the tenant a late fee for paying rent after the 5th of the month because the owner elected to delay processing, knowing the tenant has experienced a change in income.

- Once owners are able to verify the tenant’s new income, they must do as follows:

- Recertify the tenant, as described in paragraph 7-12.

- Retroactively apply any reduction in rent to the first day of the month after the date of the action that caused the decrease in income.

- Notify the tenant in writing of any rent due for the period of delay. If the tenant fails to pay this amount within 30 days of notification, the owner may pursue eviction for nonpayment of rent.

The O/A should not recertify a tenant receiving welfare assistance in an as-paid welfare program when the Public Assistance Agency reduces the tenant’s shelter and utility allowance because it is greater than the tenant’s actual rent.

Processing Interim Recertifications

When processing an interim recertification, the O/A must conduct an interview with the tenant to obtain information on the reported change and review and ask if there have been other changes to family composition, income, assets, or allowances since the most recent certification. The O/A will obtain third party verification of the income or other facts reported as changed since the last recertification and maintain documentation in the tenant file. The EIV system must be used when a tenant reports a change in employment or income to determine if any information has been provided by the employer or if the tenant had unreported income. Changes in the tenant’s rent and assistance payment will be documented by obtaining required signatures on the HUD50059 and maintaining the original copy in the tenant file. The tenant information will be updated when the certification is transmitted to TRACS.

Effective Date of Interim Recertifications

The O/A must provide the tenant with written notice of the effective date and the amount of the change in TTP or tenant rent resulting from the interim recertification.If the tenant complies with the interim reporting requirements, rent changes must be implemented as follows:

- Rent increases. The O/A must give the tenant 30 days’ advance notice of the increase. The effective date of the increase will be the first of the month commencing after the end of the 30-day period.

- Example:

- On 8/10/2025, a tenant receives a raise at work. The tenant complied with the interim reporting requirements by reporting the increase in income in a timely manner

- The tenant and management met to discuss this change, and after proper verification, it was determined the TTP/tenant rent will increase

- The tenant was provided a 30-day notice of rent increase on 8/15/2025

- On 9/14/2025, the 30-day timeframe expires (8/15 + 30 days)

- On 10/1/2025, which is the first of the month after the end of the 30-day period, the new TTP and tenant rent becomes effective

- Rent decreases. The rent change is effective on the first day of the month after the date of action that caused decrease. A 30-day notice is not required for rent decreases.

- Example:

- On 7/15/2025, a tenant lost their seasonal job. The tenant complied with the interim reporting requirements by reporting the decrease in income in a timely manner

- The tenant and management met to discuss this change, and after proper verification, it was determined the TTP/tenant rent would decrease.

- As the TTP/tenant rent is decreasing, a 30-day notice is not required

- On 8/1/2025, which is the first day of the month after the date of action that caused the decrease (7/15), the new TTP and tenant rent became effective

If the tenant does not comply with the interim reporting requirements as described in the HUD Handbook 4350.3, Chapter 7, Paragraph 7-10, most likely this results in a repayment agreement, and the O/A initiates an interim recertification and implements rent changes as follows:

- Rent increases. Owners must implement any resulting rent increase retroactive to the first of the month following the date that the action occurred.

- Example:

- On 7/13/2025, a tenant started a second job. The tenant failed to comply with the interim reporting requirements and didn’t report their increase in income until 9/2/2025 during their Annual Recertification meeting with management

- After proper verification, it was determined the TTP/tenant rent would increase

- The tenant is not provided with a 30-day notice of rent increase due to their failure to comply with the interim reporting requirements

- On 8/1/2025, which is a retroactive date and is the first of the month following the date the action occurred (7/13), the new TTP and tenant rent became effective

- Rent decreases. Rent decreases must be implemented effective the first rent period following completion of the recertification.

- Example:

- On 6/2/2025, a tenant changed positions at their job which reduced their income. The tenant failed to comply with the interim reporting requirements and didn’t report the decrease in income until 9/13/2025

- The tenant and management met to discuss this change, and after proper verification, it was determined the TTP/tenant rent will decrease

- The tenant and management signed the IR on 9/14/2025

- On 10/1/2025, which is the first of the month following the first rent period following completion of the recertification (9/14), the new TTP and tenant rent becomes effective

- Need to be Added to The CA Quarterly Publication List?

-

If you are not already receiving this publication via e-mail, click here to subscribe.

Do you have ideas, suggestions, or questions for future publications, we’d like to hear from you. Please send an email to andrew.hill@cgifederal.com

- Happy autumn, California!

-